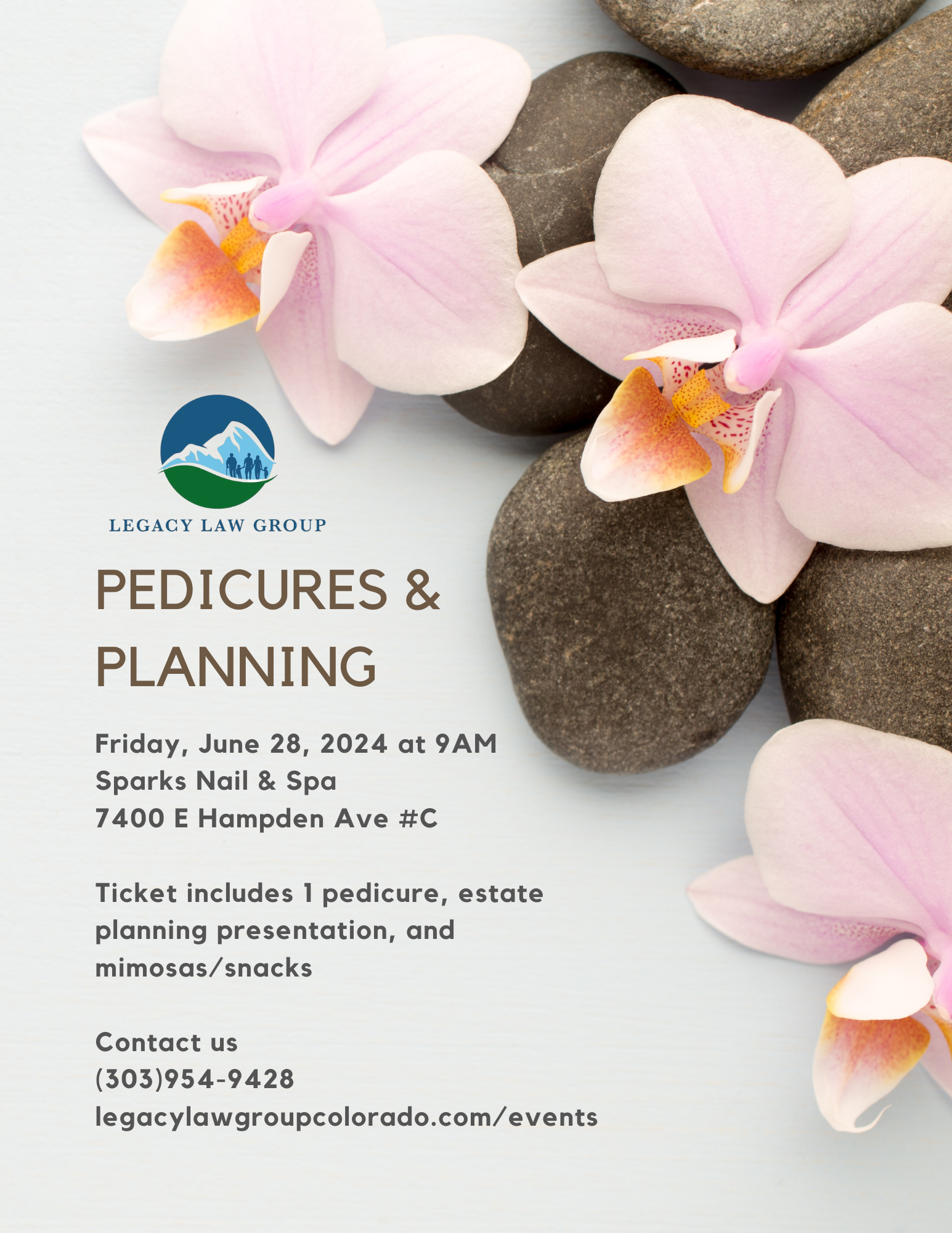

Join us for a delightful morning of self-care and future planning at our Pedicures & Planning Event! Upon arrival, you’ll be greeted with a complimentary glass of bubbly mimosa, setting the tone for a day of indulgence and productivity. In addition, this event offers an informative estate planning presentation. Led by an estate planning attorney, this presentation will equip you with essential knowledge about protecting your assets, creating a legacy, and ensuring your loved ones are taken care of in the future. Discover the importance of wills, trusts, and other vital elements of estate planning during this engaging session.

What to Expect:

- Estate Planning Essentials: Gain insights into wills, trusts, and healthcare directives from our estate planning expert.

- Legal Insights: Learn about the legal aspects of estate planning to protect your assets and loved ones.

- Q&A Session: Have your estate planning questions answered by our attorney.

- Take-Home Resources: Receive informative materials to kickstart your estate planning journey.

Secure your spot at this unique event by filling out the form above. Limited spots are available, so make sure to get yours in advance.