Denver, CO Estate Lawyer

Many people put off estate planning because they do not want to address their own mortality. It is incredibly important, however, to ensure your loved ones are cared for even after you are gone. Having an estate plan in place is crucial to carry on your legacy and protect your loved ones. You should always speak to an experienced Denver, CO estate lawyer from Legacy Law Group, rather than trying to do everything yourself. A lawyer will know how to make sure all of your bases are covered and that you think of everything necessary before you are gone.

Creating A Will

Creating a will is the most common service that people recognize estate lawyers being responsible for. It is important for people of all ages to have a will in place so that there are no questions about who should get their assets once they are gone. This can save your loved ones time, money, and even relationships with one another. By setting up a clear, concise will with a Denver estate lawyer, you are taking matters into your own hands and will hopefully allow your friends and family to properly grieve when you are gone, rather than fight about who gets what from your estate. You can write in great detail what you want to see happen to your estate, and any last wishes you have. This will allow loved ones to have peace, knowing that your last wishes are being followed. It will also make it your lawyer’s job to explain who is getting what, which can also decrease the amount of bickering between your loved ones when you are no longer around.

Appointing A Power Of Attorney

When you are doing estate planning, it is important to think about your own well-being. For example, did you know that you can name a medical power of attorney in your will? This is important because if anything ever happens to you and you can no longer make decisions on your own, a loved one you trust can make these on your behalf. You can even write more detailed wishes in your will, such as what you want to happen if you are ever incapacitated, whether or not you want to be kept on life support, if you want to be cremated or buried, and more. This will ensure your wishes are carried out, even if you can no longer voice what you want.

Donating Your Assets

There may be a charity or organization that is close to your heart. You can add donations to your final wishes. For example, if you want to leave 90% of your money to your family and 10% to an organization, you can do so. This will be important to spell out, even if you trust your family members to donate on your behalf. It can also make things like taxes easier if you plan correctly with one of our skilled Denver estate lawyers.

Contact Us Today

Do not wait to reach out to Legacy Law Group about your estate planning needs. We can go over our services with you in greater detail and speak with you about any concerns you have. Our lawyers will be sympathetic and understanding when speaking about your mortality. This may seem like a difficult task, but it is a part of life that we all need to plan for. Reach out today to get started!

Navigating The Complexities Of Estate Planning

Estate planning can be difficult, and sometimes even emotional. This is why it is important to go into it knowing a little bit about the process ahead of time. Continue reading to learn more about planning your estate. Always make sure you have a good lawyer on your side.

Understanding Estate Planning

Estate planning is a crucial aspect of ensuring your loved ones are taken care of when you’re no longer around. An experienced Denver estate lawyer from Legacy Law Group Colorado can help you navigate the complexities of this process, ensuring your wishes are carried out effectively and efficiently.

The Role Of An Estate Lawyer

An estate lawyer specializes in creating, managing, and executing estate plans. They have the expertise to draft wills, trusts, and other legal documents that protect your assets and distribute them according to your wishes.

Estate Planning Isn’t Just For The Wealthy

Contrary to popular belief, estate planning isn’t exclusive to the wealthy. Everyone, regardless of their financial situation, should have an estate plan in place. A Denver estate lawyer from our firm can help you tailor your plan to your unique circumstances.

Avoiding Probate Hassles

Probate can be a lengthy and costly process. By working with an estate lawyer, you can explore strategies to minimize or even avoid probate altogether, ensuring a smoother transition of your assets to your heirs.

Protecting Your Loved Ones

Estate planning isn’t just about assets; it’s also about safeguarding your loved ones. An estate lawyer can help you establish guardianship for minor children and ensure their financial well-being.

Minimizing Taxes

One of the key benefits of estate planning is minimizing the tax burden on your estate. An estate lawyer can help you employ various strategies to reduce estate taxes, leaving more for your heirs.

Updating Your Estate Plan

Life circumstances change, and so should your estate plan. An estate lawyer can assist you in regularly reviewing and updating your plan to reflect changes in your family, finances, and objectives.

Charitable Giving

If you have philanthropic interests, an estate lawyer can help you incorporate charitable giving into your estate plan, allowing you to leave a lasting legacy for the causes you care about.

Special Needs Planning

Families with special needs dependents require specialized estate planning. An estate lawyer from Legacy Law Group Colorado can help you set up trusts and other arrangements to provide ongoing care and support for your loved ones with special needs.

Peace Of Mind

Perhaps the most significant benefit of working with a Denver estate lawyer is the peace of mind it provides. Knowing that your wishes will be carried out, your loved ones protected, and your assets preserved can provide a sense of security and comfort.

Give Us A Call!

Estate planning is a crucial aspect of ensuring your legacy and protecting your loved ones. An experienced estate lawyer can guide you through the process, tailoring a plan to your specific needs and goals. Don’t delay in securing your family’s future and your own peace of mind. Contact our law firm today for expert estate planning assistance. Your loved ones will thank you for it.

The Importance Of Estate Planning For Young Adults

Our Denver, CO estate lawyer believes that it’s never too early to start planning for your future. While many young people may not consider estate planning a priority, the reality is that creating an estate plan can provide significant benefits and peace of mind, regardless of your age or financial situation.

Protecting Your Assets And Loved Ones

Estate planning isn’t just for the wealthy or the elderly. It’s a valuable tool for safeguarding your assets and ensuring that your loved ones are taken care of in the event of your untimely passing. Even if you don’t have substantial wealth, you likely have personal belongings, financial accounts, and digital assets that should be managed and distributed according to your wishes.

Avoiding Intestacy Laws

Without an estate plan in place, your assets may be subject to intestacy laws, which vary by state. In essence, these laws dictate how your property will be distributed if you pass away without a will or trust. By creating an estate plan, you have the power to decide who inherits your assets, rather than leaving it up to the state.

Nominating Guardians For Dependents

As noted above, if you have children or dependents, estate planning becomes even more critical. Your estate plan allows you to nominate guardians for your children, ensuring they are cared for by the individuals you trust, rather than leaving this decision to the courts.

Healthcare Decisions And Medical Directives

As your Denver estate lawyer knows, estate planning isn’t just about what happens after you pass away; it also addresses your healthcare decisions while you’re alive. Through documents like a Healthcare Power of Attorney and Living Will, you can appoint someone to make medical decisions on your behalf if you become incapacitated and specify your preferences for medical treatment.

Minimizing Taxes And Expenses

Creating an estate plan can also help minimize the tax burden on your estate and reduce expenses associated with probate. By structuring your assets and beneficiaries strategically, you can potentially save your loved ones time and money during the probate process.

Protecting Digital Assets

In today’s digital age, many young adults have valuable digital assets, such as social media accounts, cryptocurrency, and online accounts. Your estate plan can include instructions on how to access and manage these digital assets, ensuring they are not lost or neglected.

Peace Of Mind And Control

Perhaps one of the most significant benefits of estate planning is the peace of mind it provides. Knowing that your wishes will be followed, your loved ones will be cared for, and your assets will be protected can offer a sense of control and security, regardless of your age.

Work With A Team You Can Trust

We want to emphasize that estate planning is not exclusive to older generations or those with vast wealth. Young adults can benefit immensely from creating an estate plan, and it’s a proactive step towards securing your future and protecting your loved ones.

If you’re a young adult in Colorado, we encourage you to reach out to us for a consultation. Our experienced estate planning attorneys can help you craft a personalized plan that reflects your unique circumstances and goals. Don’t wait until it’s too late; take control of your future today. Contact Legacy Law Group Colorado and start your estate planning journey toward a more secure tomorrow with our trusted Denver estate lawyer.

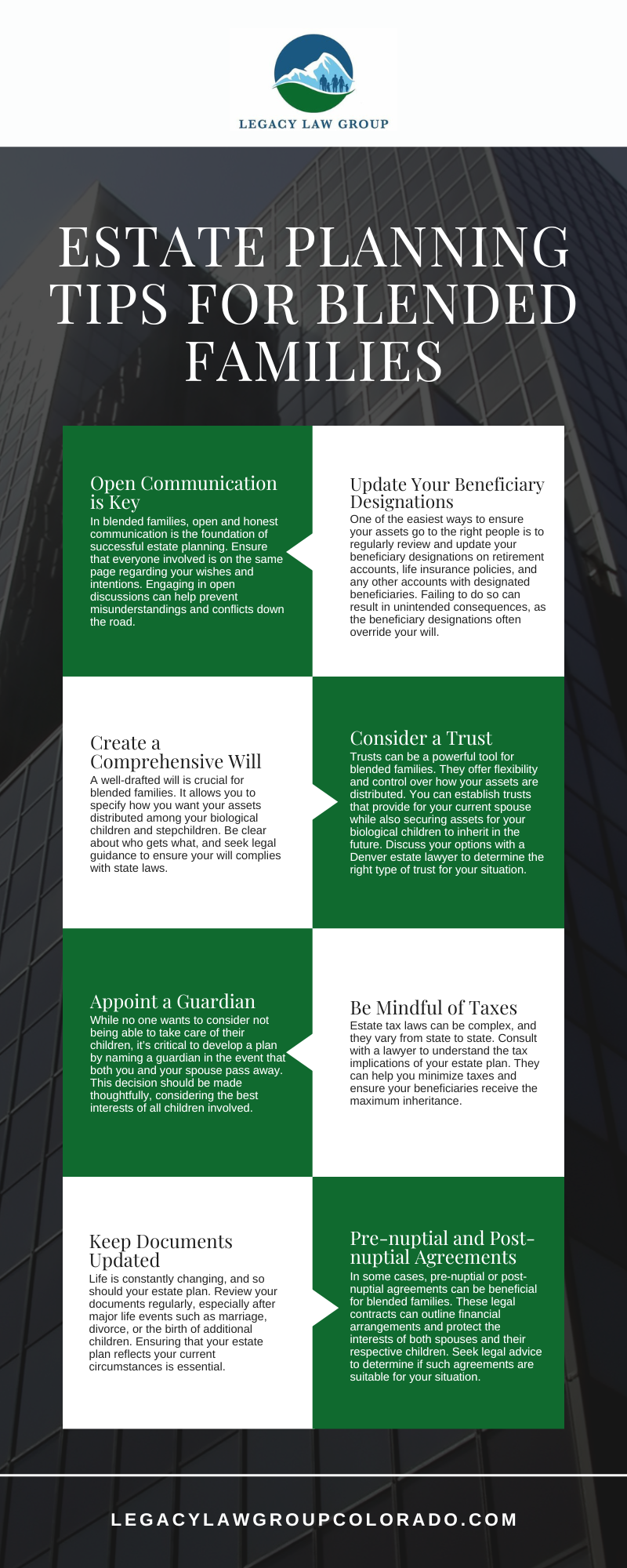

Estate Planning Tips For Blended Families

In situations that involve blended families, estate planning can be an especially complex and sensitive subject to manage. In this article, we’ll provide you with valuable estate planning tips tailored to the unique challenges and considerations faced by blended families. Our Denver estate lawyer is here to guide you through this process smoothly.

Open Communication is Key

In blended families, open and honest communication is the foundation of successful estate planning. Ensure that everyone involved is on the same page regarding your wishes and intentions. Engaging in open discussions can help prevent misunderstandings and conflicts down the road.

Update Your Beneficiary Designations

One of the easiest ways to ensure your assets go to the right people is to regularly review and update your beneficiary designations on retirement accounts, life insurance policies, and any other accounts with designated beneficiaries. Failing to do so can result in unintended consequences, as the beneficiary designations often override your will.

Create a Comprehensive Will

A well-drafted will is crucial for blended families. It allows you to specify how you want your assets distributed among your biological children and stepchildren. Be clear about who gets what, and seek legal guidance to ensure your will complies with state laws.

Consider a Trust

Trusts can be a powerful tool for blended families. They offer flexibility and control over how your assets are distributed. You can establish trusts that provide for your current spouse while also securing assets for your biological children to inherit in the future. Discuss your options with a Denver estate lawyer to determine the right type of trust for your situation.

Appoint a Guardian

While no one wants to consider not being able to take care of their children, it’s critical to develop a plan by naming a guardian in the event that both you and your spouse pass away. This decision should be made thoughtfully, considering the best interests of all children involved.

Be Mindful of Taxes

Estate tax laws can be complex, and they vary from state to state. Consult with a lawyer to understand the tax implications of your estate plan. They can help you minimize taxes and ensure your beneficiaries receive the maximum inheritance.

Keep Documents Updated

Life is constantly changing, and so should your estate plan. Review your documents regularly, especially after major life events such as marriage, divorce, or the birth of additional children. Ensuring that your estate plan reflects your current circumstances is essential.

Pre-nuptial and Post-nuptial Agreements

In some cases, pre-nuptial or post-nuptial agreements can be beneficial for blended families. These legal contracts can outline financial arrangements and protect the interests of both spouses and their respective children. Seek legal advice to determine if such agreements are suitable for your situation.

Estate Infographic

Seeking Help

Estate planning for blended families can be complex, but with the right guidance from experienced lawyers, you can navigate it smoothly. Open communication, careful document management, and thoughtful planning are the keys to ensuring your wishes are met and your loved ones are provided for.

Don’t leave your estate plan to chance. To develop a customized estate plan that reflects your unique family dynamics and financial situation it’s critical to contact our team to schedule a consultation. Your family’s future is our priority.

Denver Estate Lawyer FAQs

It’s important to contact a Denver, CO estate lawyer if you have any questions when you’re planning your future. At Legacy Law Group Colorado, we understand how crucial it is to have clear, accurate information. To help demystify the process, we’ve compiled a list of frequently asked questions about estate lawyers and what they do.

What Is An Estate Lawyer And What Do They Do?

An estate lawyer, also known as an estate planning or probate attorney, specializes in managing the disposition of a person’s estate after death and planning for incapacity. They assist in creating documents like wills, trusts, powers of attorney, and healthcare directives. Their role is to ensure that your estate is handled according to your wishes, minimizing taxes and streamlining the distribution process.

When Should I Consider Hiring An Estate Lawyer?

You should consider hiring an estate lawyer when you need to plan how your assets will be managed after your death or if you become incapacitated. This is not exclusive to the elderly or wealthy; anyone with assets, no matter how small, or with dependents should have an estate plan. Significant life events, such as marriage, divorce, the birth of a child, or acquiring substantial assets, are also good times to seek the advice of an estate lawyer.

How Can An Estate Lawyer Help With Will Drafting?

Drafting a will is more complex than just listing who gets what. An estate lawyer helps ensure that your will is legally binding and clearly states your wishes, which can prevent disputes among beneficiaries. An estate lawyer can also advise on potential tax implications and suggest ways to minimize taxes or avoid probate, ensuring that your beneficiaries receive the maximum benefits of your estate.

How Does An Estate Lawyer Help In Probate Proceedings?

During probate, an estate lawyer plays a pivotal role. They assist the executor of the will in navigating the probate process, which includes filing necessary legal documents, representing the estate in court, helping to value and distribute assets, and settling debts and taxes. Probate can be complex and time-consuming, but an estate lawyer can streamline the process, resolve disputes, and ensure that the estate is administered according to the deceased’s wishes.

What Should I Look For When Choosing An Estate Lawyer?

When choosing an estate lawyer, look for someone with specialized knowledge and experience in estate planning and probate law. Check their reputation and reviews, and consider whether their approach aligns with your preferences. A good Denver estate lawyer will not only understand the legal technicalities but will also be compassionate and empathetic, recognizing the personal and sensitive nature of estate planning.

Contact Our Office Today

At Legacy Law Group Colorado, we pride ourselves on providing comprehensive, tailored estate planning services. Our team is dedicated to guiding you through every step of the estate planning process with clarity and compassion. Whether you’re drafting a will, navigating probate, or just starting to think about your estate plan, we’re here to help. Get in touch with us today, and see how a Denver estate lawyer from our office can help.

Reach out to Legacy Law Group Colorado now and let our experienced Denver estate lawyers help you secure your family’s future with a well-crafted estate plan. Your peace of mind is just a phone call away!

Anastasia Fainberg

Client Review

"We recently used Anastasia for creating a Family Trust. I highly recommend this Legacy Law Firm for any family law needs you might have. Anastasia and her staff are compassionate and highly professional, no pressure, but they will go over all aspects. Couldn't be more happier with their service."

Irina Shamaev

REACH OUT TO OUR TEAM

Learn More About Anastasia

Anastasia FainbergAttorney at Law